BRIC: unleashing the rebound in the manufacturing sector

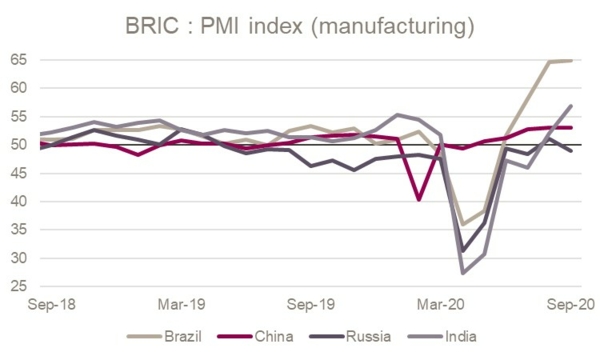

The BRIC countries (Brazil, Russia, India and China) form an important economic block, accounting for more than 40% of the world's population and just under 25% of global GDP. As the global manufacturing recovery strengthens at the end of the third quarter (JPM Global PMI index at 52.3 in September from 51.8 in August), BRICs manufacturing sectors are moving at three different stages.

China: the rebound is solidifying

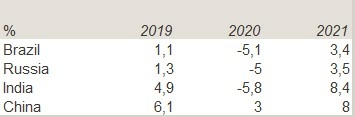

The manufacturing PMI index came in at 53 in September, above the 50-level separating growth from contraction and slightly below the consensus forecast that expected no change compared to its August level of 53.1. China’s manufacturing sector maintained strong momentum in September with firms signalling further distinct increases in production, propped up by the surge in exports orders (close to 55 points). The employment index stabilised, after 8 months of indicating job shedding. The labour market in China is most likely in worse conditions than suggested by the official low urban unemployment rate (5.6%) as workers returned to provinces during the peak of the sanitary crisis. The recovery in employment is a key driver for the return in Chinese consumer demand, which thus far has been a weak contributor to growth. With the forward-looking new orders subcomponent rising again, China’s recovery appears to be gaining traction. The Chinese economy is expected to grow by 3% in 2020, benefiting from the recovery in external demand and strong input from public investment.

India & Brazil: a V-shaped recovery in optimism

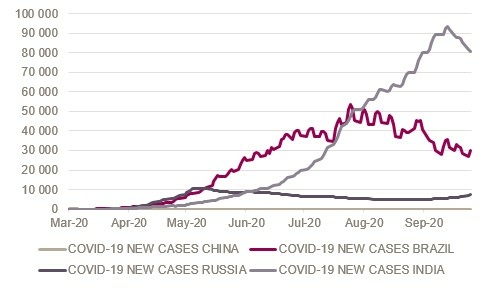

India and Brazil represent the second and third worst hit countries in terms of number of COVID-19 cases.

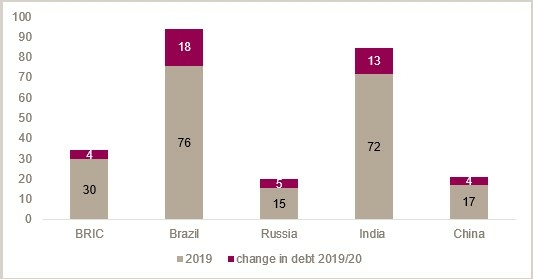

The lockdowns were particularly severe in these two countries and saw industrial production drop a staggering -57% year-on-year in India and -27% in Brazil at the peak of their respective crises in April. Since production has improved, but remain below 2019 levels during the same period (-10% and -3% respectively in July). Survey data points to record levels of optimism from manufacturing firms as pandemic measures are progressively loosened. In India, the PMI manufacturing index soared to a 56.8 in September, largely surpassing the consensus forecast of 52.8. Whereas, Brazil’s manufacturing PMI continued to expand for the second consecutive month, rising from 64.7 in August to 64.9 in September. These figures are off the charts, and represent strong mechanical rebounds in business sentiment after an exceptional period and with the announcement of robust fiscal stimulus plans. Brazilian firms pointed to an acceleration in employment in September, while Indian corporates appear not to be sufficiently confident to stop the sixth month long job-cutting trend. All in all, we should expected to continue to see more solid industrial growth figures as the technical rebound in these countries, but the recovery remains fragile as the pandemic continues to linger, especially in India, and stimulus plans will add to the already high public debt ratios.

Russia: the growth straggler

In contrast to its counterparts, the Russian manufacturing industry remained subdued in September; the PMI Index remained below the 50-mark threshold indicating a new contraction of activity in September (48.9 down from 51.1 in August). The employment index in manufacturing also fell further amid lower new order inflows. The Russian industrial sector as a whole is suffering from the contraction in the extraction of raw materials (-11.8 percent in August) as well as a reduction in the distribution of electricity and gas (-3.6 percent vs -2.6 percent). With a current account surplus (1% of GDP), low public debt (15% of GDP end 2019) and a relatively well contained pandemic thus far, Russia is relatively better equipped than in the past to face the current crisis. However, social distancing restrictions and the collapse of commodity prices are expected to continue to weigh on growth. Russian GDP is expected to contract by 5% in 2020.

All in all, China remains the growth driving manufacturing sector, opening up its economy from lockdown early enough to benefit from the recovery in external demand. The recovery in Brazil (and to a lesser extent India) appears to be gaining traction, but we remain reserved on Latin America given the relatively weaker economic fundamentals behind these economies.

Source: Markit, Datastream, Indosuez Wealth Management

Source: Reuters, Datastream, Indosuez Wealth Management

Source: Focus Economics, Indosuez Wealth Management

Source: CA CIB Economic Research, Indosuez Wealth Management

October 02, 2020