Central banks: actions & implications

It was a loaded week for central banks across the globe as the fight against inflation endures. Investors can no longer afford to wait for a Fed pivot and need to adapt their portfolios to this new framework of low growth / high rate environment by building a yield-generating resilient portfolio. The massive GBP market sell off is a lesson to policy makers that there is no such thing as a free lunch, and inflation will need to be fought the hard way.

1- Key decisions taken by policy makers this week: wrap up

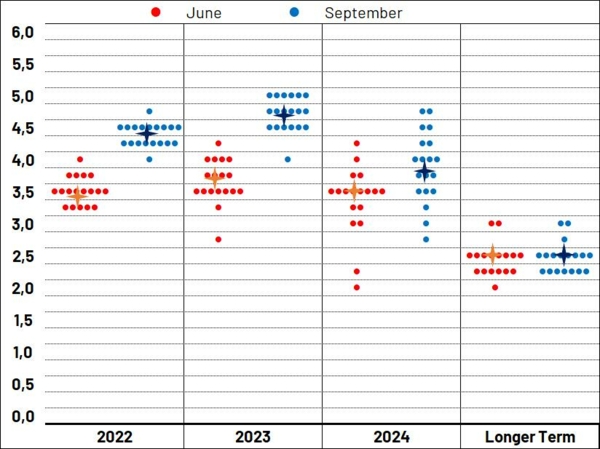

The Fed has as expected raised interest rates by another 75 basis points (bps) this week, bringing the upper band of the target rate to 3.25%, a level unseen since 2005/2008. More importantly, the Fed unveiled its famous "dot plots" (charts of growth, employment, inflation and rates forecasts) that suggest an almost 2-year long plateau of elevated interest rates (Chart 1).

The Swiss National Bank (SNB) has also raised rates this week by 75 bps, a historic move bringing rates to 50 bps, and stands ready to intervene on foreign exchange markets if necessary, both in case of an excessive appreciation against the euro (which could weakens industrial external competitiveness) or in the case of excessive depreciation against the US dollar (which would inflate energy imports).

The Bank of England (BoE) has brought its interest rate by 50 bps to 2.25%, in a tight 5 against 4 vote, with almost half of its members voting for a 75 bps increase in a double-digit inflation context in the UK. On the fiscal front, the new Prime Minister delivered the most intense tax cuts seen since 1972, cutting levies on rich households and companies in hopes of stimulating growth. The latter triggered a massive market sell off of the currency and bonds. A badly timed occurrence, a day after the BoE also announced quantitative tightening. It was clearly a difficult week for Brits as the UK service sector PMI also came in below the 50-mark threshold dividing an expansion from a contraction in activity.

Finally, the Bank of Japan has not reversed its accommodative stance, keeping the yield-curve control in place. However it has started to intervene against the worrisome weakening of the yen.

2- Key take-aways from monetary policy decisions

Nothing seems to derail central banks for their commitment to fight inflation so far; neither weaker macroeconomic prospects not tighter financial conditions.

The central bank playbook is based on a stagflationary reading of the situation. It is high inflation that is now the driver of a weakening economic cycle. Fighting inflation is a prerequisite for the economy to return to a medium term growth path, even if it means further weakening growth and employment in the short term.

Weakening market expectations regarding US inflation (US 2-year inflation breakevens have fallen to 2.3%) do not mean that the Fed considers that its job is done; to the contrary, it wants to see evidence that realised inflation goes down before relaxing its tightening cycle.

No pivot in sight for the Fed

After the July FOMC meeting, investors were betting on the fact that the Fed was transitioning from an automatic rate hike phase to data-dependent phase of action, which could have signalled a near term pivot of the Fed’s communication potentially as early as Jackson Hole. We did not subscribe to this optimistic reading, but we did subscribe to the idea that a more accommodative turn could occur in the first half of 2023. Investors must now adapt to a new reality: this Fed is ready to bring the economy further down and seems to be convinced that a plateau of elevated rates is necessary to bring down inflation by putting an end to the wage / price spiral.

The US dot plots suggests that the Fed wants to bring real rates into positive territory and maintain higher rates for two years. It is already the case when comparing Fed funds rates to 5-year inflation breakevens; but real rates remain negative when compared to actual realised inflation. However, in 2023 the Fed funds should surpass the rate of inflation.

Finally, forex volatility is a rising source of concern for other central banks as it is a source of imported inflation. While we do not see a new Plaza agreement (orchestrated and concerted fall of the US dollar in 1985) coming, we should expect more forex intervention down the road, contrasting with two decades where the monetary policies of the major central banks was solely driven by domestic macroeconomic objectives.

3- Macroeconomic implications

Inflation

These decisions should continue to drive inflation expectations down, and will have an effect in the US on realised inflation through a softening of consumption, employment and investments (see below). However, as European inflation is much more supply driven, it is more a mix of fiscal policy on energy as well as tighter monetary policy that can cool down inflation.

Employment and growth

The September composite PMI survey that combines activity in the services and manufacturing sector came in below 50 for the US for the third consecutive month this week. Economic growth will start to bear the scars of this tighter policy; indeed the Fed’s projections have cut median 2023 GDP growth to 1.2%, slightly higher than our assumption (of 1% average annual GDP growth). However, it seems to us increasingly unlikely that the path adopted by the Fed will be able to keep the unemployment rate below 4.5% as the dot plot suggests (4.4% unemployment in 2023 and 2024).

Private sector investments should indeed react to a weakening growth and rising cost of debt and this is usually the accelerating driver of the economic downturn, what separates soft from hard landings. The US economy is de facto increasingly on a tight rope between these two scenarios.

Real estate

As we wrote on several occasions since spring 2022, US real estate prices are not immune to monetary tightening of this magnitude. The sequence is usually as follows: rising mortgage rates start to hit transactions volumes, and prices then follow with a six month delay. With mortgage rates at 6%, it is hard to believe that we can avoid a turnaround in prices. However, the Fed does not seem to be worried by a normalisation of prices that were propelled by a decade of monetary easing.

Government debt ratios

Fiscal sustainability questions will undoubtedly resurface and are already apparent in interest rates of European peripheral countries. While it is usually expected that inflation boosts nominal GDP and mechanically eases debt-to-GDP ratios, this context is different as fiscal policy is mobilised against inflation in 2022 and 2023. If GDP growth and inflation are to fade before interest rates go down again (under the assumption of an 18-24 month plateau of elevated rates for instance), this will inflate debt servicing costs. Investors will particularly look into the average maturity of public debt to assess the speed of increase of debt servicing costs.

4- Cross asset implications for investors

This context further increases the gravitational force of USD liquidity, whose yield has become very attractive (3.6% at 3 months, 4.8% at 12 months).

Yield curves should normally invert more as more front-loaded rate hikes should weaken medium term growth prospects further. With a close to -50 bps inversion on 30Y-2Y, we are getting closer to levels recorded in Q2 2000. However, such a stagflationary environment as today can bring the yield curve to more inverted levels for longer than in more recent cycles, with the exception of risk aversion brought by unsustainable fiscal policies (as in the UK) which drives risk aversion on government bonds and more yield curve steepening.

The repricing of equity markets is set to continue in the next quarter. A 50 bps upward adjustment on Fed rates for next year (Fed rate capped at 4.5%), with inflation expectations brought down below 2.5%, is in turn calling for lower equilibrium price / earnings ratios. We continue to think that it is now largely the future path of earnings that will determine the equity market outlook and that the repricing due to higher rates is largely done, but every additional hawkish step from the Fed is driving the equilibrium valuations metrics down for equity markets.

Investors should therefore adapt their portfolios to this new framework, rather than waiting on a near coming pivot to come back on growth stocks. Investors need to build yield-generating resilient portfolios in a low growth / high rate environment.

In this context, we continue to favour a mix of short duration investment grade bonds, resilient dividend and cash flow generative equities, and a rising level of cash now rewarding investors with more attractive returns, while limiting exposure to interest rate and cyclical risks.

This high volatility environment on rates, equities and forex markets also provides attractive opportunities in option-based strategies and structured products.

In conclusion there is a good piece of news in this difficult change of paradigm: the return of yield, which should remain the focus of investors in the next 12 to 18 months.

Chart 1: The dot plot - Fed official’s projections for short term rates (%)

Source: Bloomberg, Indosuez Wealth Management.

September 23, 2022