Inflation in China: persistent weakness

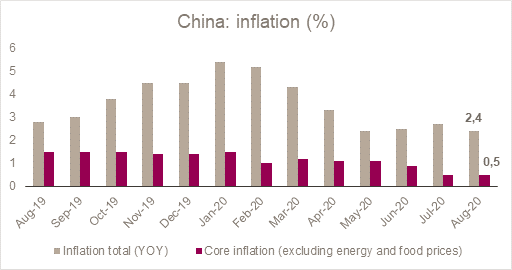

This morning, the National Bureau of Statistics released China inflation data for August. On an annual basis, global inflation fell to 2.4% versus 2.7% the previous month, in line with economists' expectations. On a monthly rate, the consumer price index is at 0.4% compared to July, which is also down compared to a previous increase of 0.6%, but a return to positive territory after negative monthly growth registered from March to June.

As in previous months, inflation in China was strongly offset by the impact of food prices, up 11.2% annually, due again to the swine flu, which brought about a sharp increase in pork prices by 52.6% compared to last year (and an increase of 85.7% in July compared to the previous year). Over the next few months, this base effect is expected to subside, and headline inflation is expected to converge to non-food inflation. Food represents an overall 2.3 points of the 2.4 points of inflation in August.

Source: National Bureau of Statistics of China, Indosuez Wealth Management

Excluding food, the consumer price index is consequently barely in positive territory, at 0.1%, after a flat July. The measure of inflation excluding food and energy prices has therefore remained stable at 0.5%. In terms of industry, the producer price index is in negative territory, at -2% on an annual basis, although improving over the last 4 months, reflecting the deflationary shock on raw materials this year.

In conclusion, these inflation statistics suggest that monetary policy in China should remain accommodative, or even that actions may be amplified. For the moment, the PBoC seems to be refusing to initiate further rate cuts, but this persistent low inflation could push them to change position. Indeed, real interest rates are now above 2%, an issue raised by Standard & Poor’s last month as a potential brake on the strong recovery of activity in China. It is also a possible slowdown in the recovery that could trigger a further cut in rates, as the PBoC has repeatedly recalled this year that its focus is on economic growth and currency stability, recently favouring the liquidity injection lever as the monetary policy instrument.

September 09, 2020