Paint it black… really?

Investors anticipate a recession in Europe and a strong slowdown in the US, with peaking (but persistent) inflation. In this context, could there be a risk of being too pessimistic in a situation where macro data is relatively weak, but still slightly better than expectations? The worst is never certain in the end… Let’s dig a few questions surrounding the key dimensions of the scenario for 2023?

1. Are macro data that bad and are we really heading to a recession?

The colours of the most recent macro data are not all that dark and are more shades of grey or red. Indeed, the recent activity survey (PMI) revealed a picture that suggests a contraction of activity in the Euro Area, but not as bad as expected: the Euro Area PMI came out at 48 (vs. 47 expected), below the 50-threshold indicating a mild contraction in activity.

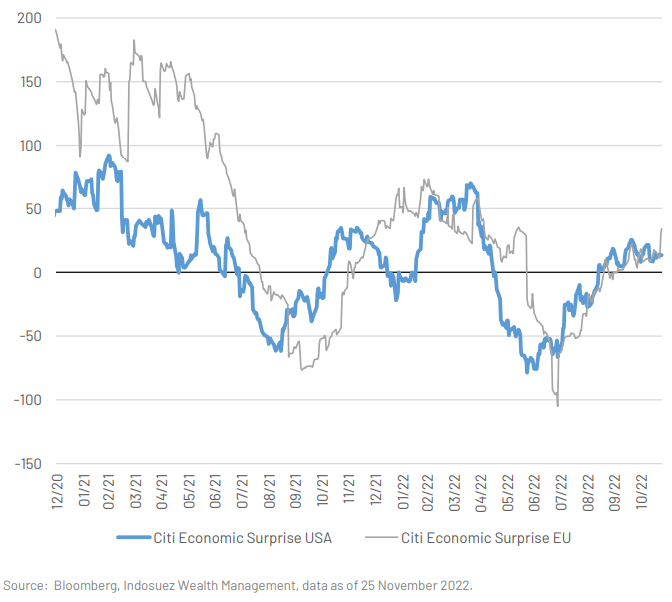

In the US, the picture is also not as gloomy as we could fear. In fact, the peak level of pessimism had probably been reached in June or September. This is at least what the level of Citi Economic Surprises (Chart 1) tells us, with a bottoming out in June. The same message was also displayed by the Michigan survey on US consumer confidence, which rebounded slightly since June’s low levels. Since then, Q3 GDP came out better than in the first half of 2022.

In Europe, what could lead us to be less pessimistic largely lies in the hand of governments: the degree of fiscal support in 2023. Public deficits will remain largely negative in 2022, as spending on COVID-19-support was replaced by inflation protection measures. The extent of this support varies in function of the fiscal headroom, with countries with significant debt-burdens unable to significantly increase spending beyond their inflated interest payment burdens.

Nevertheless, what will be most important for central bankers will remain the speed at which inflation decreases. The normalisation of job market conditions still continues to show a strong, broad-based rise in wages. The increase in unemployment and jobless claims is modest; not adjusting as fast as the real level of GDP growth would imply.

All in all, we are heading towards recession in the Euro Area, albeit more mild than expected and with a significant fiscal multiplier upside in less debt-ridden member states. In US the slowdown is beginning, but inflation is the main concern.

Chart 1: Citi Economic surprises Indicator (points)

2. Will inflation cool down rapidly in 2023?

This is probably where better macro news become cynically bad news for markets. Jerome Powell’s hope is that the rise in interest rates and subsequent slower GDP growth prospects will cool down job creation. So far, this has had limited effects, probably because rate hikes are recent and take time to kick in, probably because we are experiencing a relatively structural shortage of workers. In other words, as long as there is an important level of unfilled positions with a strong ratio of job openings / job seekers, wage inflation will not significantly cool down.

In the past few months, the US weekly jobless claims have increased steadily from 190 thousand to 240 thousand, but this is nothing compared to the pace of job destruction in past recessions (>600 thousand in 2009) and during the pandemic (>6 million at its peak).

So if this environment of stagnation with low unemployment persists, it makes the equation for the Fed more complex, as it will need to keep rates elevated for longer, until it sees some effect on the job market.

On the other inflation components, we expect the decrease of real estate prices to impact rents in the coming months; core inflation should effectively decrease more significantly after Q1 2023. Overall, it is expected that inflation in Q4 2023 will even slow towards 2 / 2.5%.

What makes us a bit uncomfortable though is that investors reacted very optimistically to the most recent inflation figures that was below expectations by a very little (core inflation at 6.3% vs. 6.4% expected). Total inflation month-on-month total inflation was stable at +0.4%, and year-on-year below 8% for the first time since February. Therefore, the peak of inflation is clearly behind us, this is certain. Does that mean though that inflation is dropping sufficiently to justify a dovish turn of the Fed? This remains far from certain.

3. Will central banks tighten excessively or should we expect a dovish turnaround?

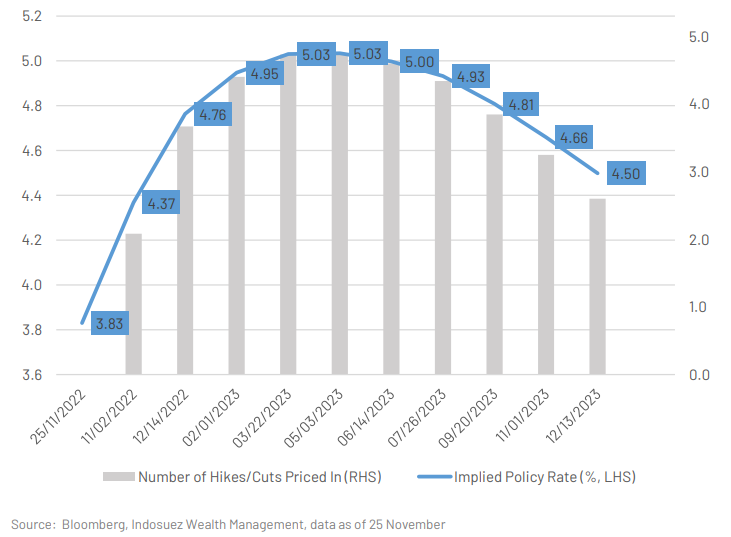

Let’s start with what markets currently expect: a 5% terminal rate reached in March, with a 50 basis point (bps) hike in December and then probably two more hikes of 25 bps in the first quarter of 2023 (Chart 2). So there is no debate about the fact that the pace of future rate hikes will slow. However, we still see a great deal of market reaction when an FOMC member speaks out on the slower pace of rate hikes to come.

Chart 2: the market’s expectations on the Fed interest rate hiking path (number of hikes and rate expect in %)

How can we interpret this? May be because some investors remain antsy and still fear that the Fed could remain more hawkish than expected by markets, as it has been the case in the past months. The most probable assumption remains the “short memory effect”, which makes that our anticipations and fears are largely influenced by the most recent past and by our most painful experiences. Furthermore, investors may still fear a more hawkish Fed and are reassured when the “slower from now on” speech is being pronounced. This short term noise has its importance, as it is the current catalyst for the rebound in equity markets.

For us, as we wrote it last summer, the main question is rather about the length of this restrictive policy. Even if rate hikes are to slow, how long are we going to stay at elevated rates before a dovish pivot comes? Our scenario so far was characterised by a 6 to 9 month pause in rate hikes at elevated levels before the Fed engages in rate cuts in Q4 2023 or Q1 2024. We are running the risk of being too cautious if, in the end, the Fed does not go to 5% and cuts before. But if this remains our base case - if more moderate hikes and a pause are already priced in - there should not be any significant reaction to the materialisation of a more dovish scenario. Still, the publication of the Fed minutes confirming this scenario of lower-rate hikes drove optimism in markets on 24 November, with repercussions on the German Bund which compressed by 9 bps.

4. Corporate margins ahead: soft landing, hard landing or structural trend of margin pressure?

In the past four economic downturns, corporate margins have on average decreased by 4 to 5 points. If we do not predict margins will return to their past crisis levels and we give some credit to the transformation of capitalism by technology, we should normally predict a decrease in margins of at least 3 points from the record-high margin levels of 2021, when S&P 500 net income / revenues hit 13%.

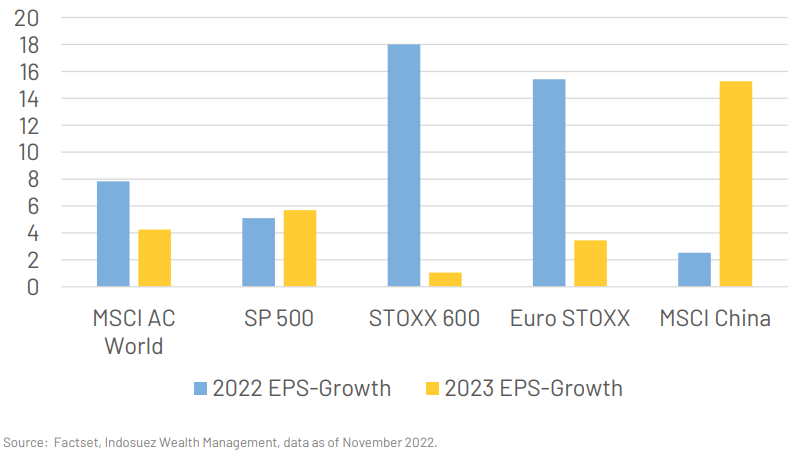

This is clearly not what markets expect for the next year (Chart 3). As we speak, markets anticipate approximately 6% earnings-per-share (EPS) growth in 2023 in the US and 3 to 4% EPS growth in the Euro Area.

Chart 3: EPS growth expectation (%)

So here as well, the question is whether we are too bleak considering that we should expect a negative EPS growth next year. In a way, there is some contradiction between an equity market pricing still solid EPS growth and a credit market pricing a rise in default rates.

Behind these somewhat optimistic, solid numbers in 2023, investors actually expect a quasi-stagnation of earnings in the first half of 2023. EPS forecasts started to decrease in June, but appear to have stabilised in the past 2 weeks. Looking at margins, which now stand at 11.9% (compared to the 13% peak level in 2021), markets expect them to stay above 12% next year as they assume higher revenue than EPS growth. This is probably what we see as the mostly challenging assumption, unless of course input costs start to decrease.

What is also interesting is to see that analyst price targets imply an S&P 500 at 4470 points, 13% above current levels. If target prices are carrying a structural bull bias, that does not leave us a huge upside. This is, probably due to the recent cuts in stock market price targets, and also hides huge discrepancies in terms of upside by sector. Consumer and communication sector price targets indeed suggest an upside above 20%, but only around 5% for industrials, materials and staples. But from which valuation levels are we starting?

5. Are current valuations attractive or becoming vulnerable after the recent rebound?

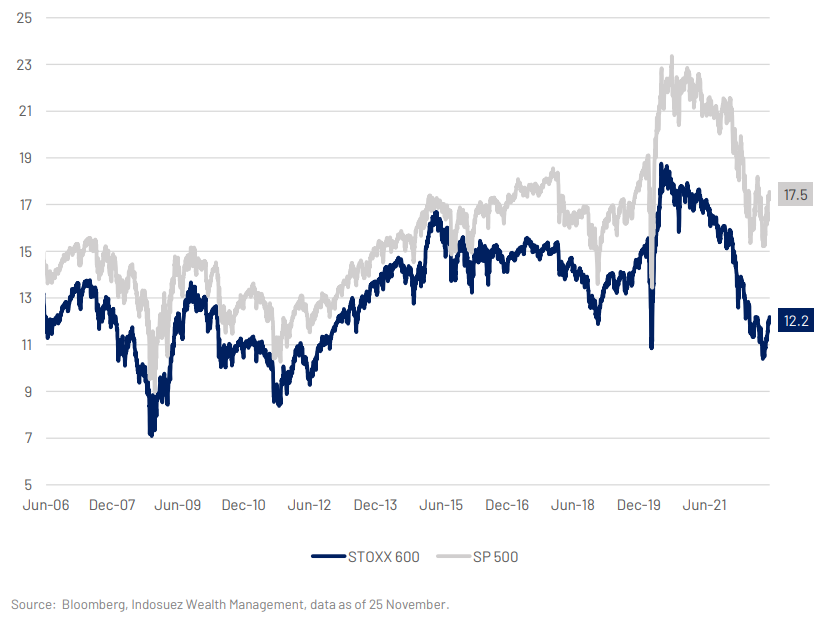

After the recent rebound, US Equities are now trading at 17.5x earnings over the next 12 months, exactly in line with the last 5-year average (Chart 4). However, this current valuation metric compares with an era of low interest rates, which generally deserves a higher equity multiple, as future cash flows are worth more when interest rates are low.

Chart 4: 12-month blended forward Price/Earnings ratio

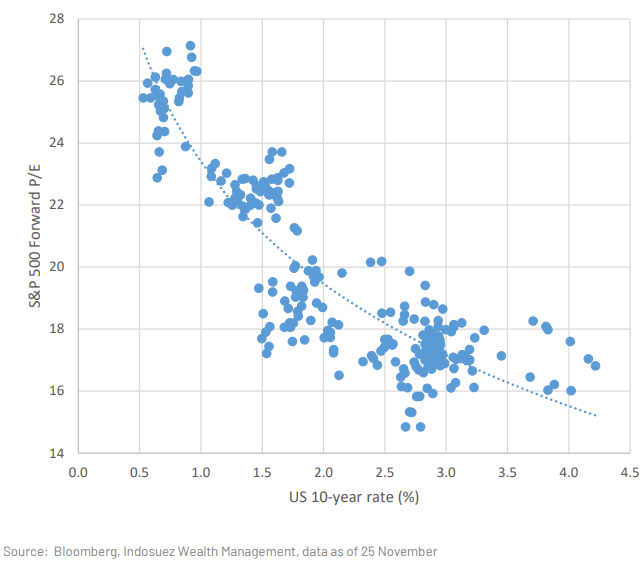

The regression analysis (Chart 5) of the US 10-year rates against the price-equity ratio (P/E) confirms that: historically a rise in the 10-year rate from 1% to 4% should deflate the equity of P/E ratio from 21 to approximately 15x earnings. Therefore, if we maintain the same valuation multiples than in the past 5 years with higher interest rates, this means that the equity risk premium is tighter.

Chart 5: the regression analysis: US 10-year rates (%) vs. S&P 500 forward Price-Equity ratio (points)

The situation is less tight in Europe, which trades at more attractive P/E (around 12x), at a close to record level of discount vs. the US market, but the risk is rather on the technical side, with a strong rebound recently above moving averages, and thus vulnerable to a technical correction.

Beyond earnings, what could in the end ease these valuation multiples is of course the level of long term rates in 2023. And in the context of November 2022 where long term Treasury yields have been receding, thus contributing to the current market rebound. This is notably why we remain sceptical on the sustainability of this rate-driven rally ahead of the December Fed meeting.

6. Political risks: high uncertainty or a better balance of news in 2023?

Over the past two years investors have been caught by political and geopolitical risks, notably by the regulatory and sanitary tightening in China and the conflict in Ukraine. Contrary to past events such as the invasion of Crimea in 2014, this conflict had major implications on our economies, whilst the regulatory crackdown in China alongside a strong slowdown weakened the earnings growth of Chinese equities.

Going forward, while the environment remains very uncertain, we believe that the balance of risk should be a little bit more positive in 2023, which could see both the reopening of the Chinese economy and potentially a military defeat of Russia, which would not necessarily mean a peace agreement, but at least a cease-fire. This will require patience, however, as investors have experienced many false starts on Chinese equities in the past year and many hopes of reopening or relaxing of COVID-19 policies that were not confirmed in the end.

In the longer run, the US/China rivalry should remain the geopolitical backdrop of this decade and century, but we do not expect the Taiwan question to be a central issue in 2023. 2024 looks more risky in that respect, especially as we approach the US election. More broadly speaking, we believe that we will not return to the geopolitical and industrial equilibrium that prevailed before the COVID-19 crisis: there is clearly some form of reshuffling at work in both alliances, and supply-chains. Companies are now integrating more country risk in their decisions to locate/relocate their factories and in their choice of partnership. We do not call it deglobalisation, but more a regional and more unilateral approach of globalisation. This could trigger less integrated macroeconomic cycles and could favour domestic plays on equities.

7. Financial risks: what should we fear in 2023?

This economic and financial sequence has not much in common with the COVID-19 crisis or the great financial crisis and its sovereign crisis aftermath in the Euro Area in 2011/2012. However, the main risk that we identify is the rising unsustainability of fiscal policies in the US and Europe. The response of the COVID-19 crisis led to an increase in the debt-to- GDP of 10 to 15 percentage points in mature economies. In 2022, the energy crisis (with the spill-over of gas prices to electricity) pushed governments to implement energy price shields, transforming inflation into greater deficits and debt.

This is what makes this so different from the situation 10 years ago: a completely opposite policy mix. The Euro Area responded to the sovereign crisis of 2011 with fiscal austerity and monetary accommodation. The stagflationary environment of 2022 imposes a much tighter monetary policy, putting an end to the concept of “QE[1] infinity” (the idea that the ECB would hardly exit negative rates and balance sheet support). This is putting pressure on governments and reducing their fiscal room to manoeuvre, with a steady progression of debt servicing costs in the coming year(s). At the same time, the recessionary environment makes it difficult for governments to cut spending when social emergencies are numerous and when climate transition requires investments. But to put it simply, they will have to make a tough choice between more inflation, more deficits or more taxes. What we are seeing is a relatively uneven fiscal and energy strategy in each country, a disorder not well hidden by the attempt from the Commission to provide a coordinated energy strategy.

It generally does not take long before markets become worried about debt sustainability. This is already what we are seeing in 2022, with rising sovereign spreads and with a first serious warning on the UK unsustainable fiscal program, halted by markets and rating agencies and leading to the fall of ex-Prime Minister Liz Truss. What remains very different from 2008/2012 is the robustness of bank balance sheets, with much higher solvency and liquidity levels, making it much harder to anticipate a transmission from sovereigns to financials.

Even if “what we should fear is fear itself” (F.D. Roosevelt), this is definitively a risk to consider and address in 2023.

8. Conclusion: what should we expect?

In brief, investors should approach 2023 with reasonable expectations and avoid equally to be too optimistic or too bearish, whilst remaining reactive to macro signals and bottom-up news flow.

2023 should see the return of bonds as core assets in portfolios. We wrote in September that 2023 could be the return of the 60/40 portfolio and we still believe so. Among fixed income, we still have a preference for corporate bonds of intermediate duration that investors should hold to maturity.

In 2023, most investment profiles should generate returns above 5% given the current level of yield to maturity on bonds (4% in Euro and 6% in dollars on aggregate indices) and the level of shareholder returns.

2023 should be a year in two distinct parts:

- a first moment where carry and dividend will still dominate, and where cash / term deposits will still exercise a strong gravitational force for investors seeking moderate volatility. Investors should thus start the year with a balanced positioning, with no excessive risk taking on equities, and a focus on quality stocks and bonds with intrinsic yield, without significant hope of valuation re-rating, especially after the recent rebound;

- A second moment, with a potential synchronisation of earnings growth and macro signals bouncing back in the same timeframe as central banks dovish turns in mid-2023; this alignment should be much more favourable to equities and more risky fixed income assets, whilst a reversal of the US dollar strength could help emerging debts and currencies.

November 25, 2022